Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

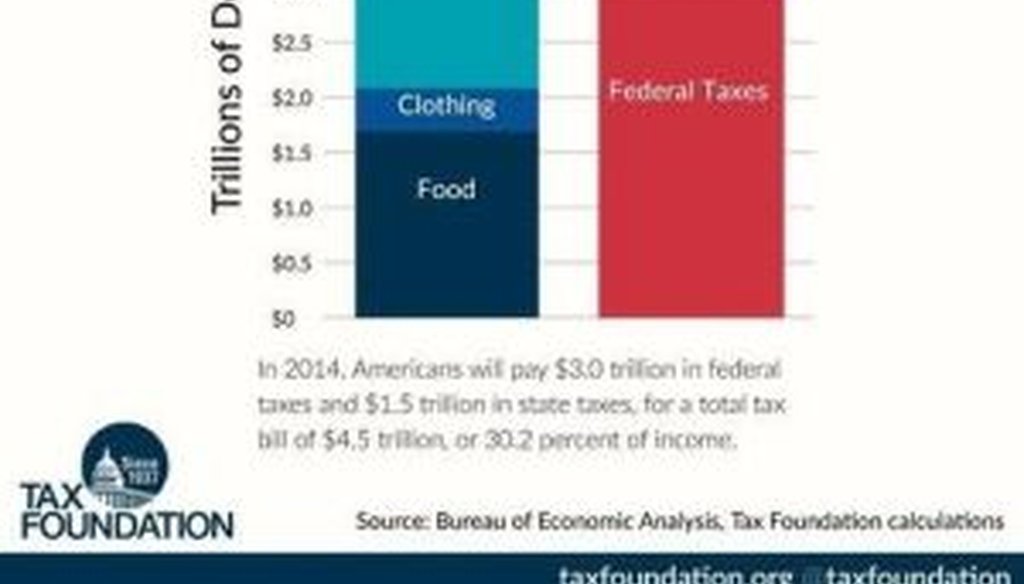

In this social media-friendly chart, the Tax Foundation offers data showing that Americans pay more in taxes than in food, clothing and housing combined. Is that correct?

With the April 15 tax deadline a fresh memory, Americans have seen an uptick in social media posts about taxes. One reader saw a Facebook post and forwarded it to us, asking whether it was accurate.

"Americans will spend more on taxes in 2014 than they will on food, clothing and housing combined," the post said, and it included a chart showing that the combination of state, local and federal taxes exceeded the amount spent on food, clothing and housing. The post was credited to the Tax Foundation, a think tank that generally has a pro-business leaning.

The claim sounded familiar to us -- in 2011, we checked a statement by Republican National Committee chairman Reince Priebus that "Americans will pay more in taxes in 2011 than they will spend on groceries, clothing and shelter combined." We rated that claim Half True.

Experts told us that our previous analysis was generally applicable to the new claim as well, but it’s been three years since we checked it -- and the claim is still circulating on social media -- we thought it would be worth taking a second crack at it.

First, we’ll note that no one knows for sure how Americans will allocate their money in 2014, since more than half the year hasn’t happened yet. The best we can do is extrapolate from previous years. Given the data available, the last year for which we can do it fully is 2013.

We began our analysis by measuring expenditures on groceries, clothing and shelter. For this, we turned to the same source the Tax Foundation did -- the Bureau of Economic Analysis, an office within the U.S. Commerce Department. In a data series known as National Income and Product Accounts, the bureau tracks how Americans spend their income.

For 2013, Americans spent more than $884 billion on food and beverages consumed at home, and an additional $737 billion on restaurant meals and beverages. For clothing, the figure was $363 billion, and for housing and utilities, it was $2.083 trillion. Total expenditures: $4.067 trillion.

For taxes paid, we also turned to the Bureau of Economic Analysis. The amount of federal taxes collected in 2013 was $3.041 trillion, and the amount of state and local taxes collected in 2013 (minus transfer payments from the federal government to the states) was $1.54 trillion. Combined, that’s $4.581 trillion.

This makes the Tax Foundation correct in saying that the aggregate amount of taxes paid exceeds the aggregate amount spent on food, clothing and housing. It’s possible to quibble with both sides of this comparison -- the tax figure includes corporate taxes, while the expenditures side includes such items as alcoholic beverages -- but generally speaking, the tax figure is modestly higher than the expenditures on food, clothing and housing, giving the claim a solid grounding in the numbers. (We should note that taking out corporate taxes doesn't make much of a difference; taxes on individuals alone would still outstrip the other category.)

This is not the only way to calculate it, however.

While the Tax Foundation’s method shows that Americans as a whole pay more for taxes than for food, clothing and shelter, there are wide variations in what individual Americans pay.

According to the Bureau of Economic Analysis, taxpayers in the aggregate spent 3.2 percent of their consumption on clothing, 14.1 percent on groceries and restaurants, and 18.1 percent on housing and utilities. Combined, that’s a little over 35 percent of individual income.

Because our tax system is progressive, people with lower incomes typically don’t pay 35 percent of their income in taxes. According to the Urban Institute-Brookings Institution Tax Policy Center, American households earning under $200,000 a year don’t pay more than 20 percent of their cash income in federal taxes. The rate rises to 31 percent for those earning more than $1 million a year.

Once you add in state and local taxes, Americans $200,000 and up may well see 35 percent or more of their income going to taxes, depending on the state and locality where they live. But for those near the bottom of the income scale, the tax burden is much lower.

The federal tax burden doesn’t hit double digits until $30,000 in household income, and for those earning between $75,000 and $100,000, the rate is a bit over 17 percent. Even adding in state and local taxes, most taxpayers in these categories are not going to be paying 35 percent of their income in taxes.

And remember that there are two parts to this equation. While Americans on average pay 35 percent of their income for food, clothing and housing, some pay more than that, and some pay less.

We couldn’t find statistics on consumption patterns for different income classes. But generally speaking, the poorer you are, the higher a share of your income you’ll pay for these basics of life, and the richer you are, the smaller a share of your income will go to food, clothing and housing.

So richer Americans may well pay 35 percent of their income in taxes even as they pay a much smaller fraction on food, clothing and housing. For these people, the Tax Foundation’s claim is correct.

But poorer Americans will tend to pay a far higher share of their income for food, clothing and housing, and they won’t pay very much in taxes. For them, the foundation’s claim isn’t true in many cases.

It’s hard to say whether the Tax Foundation’s claim is true more often than not, but there’s reason to think it may not be true in most cases. That’s because, according to the Tax Policy Center, upper-income groups account for a smaller share of the population.

Households earning $114,484 or more -- a group that includes households most likely to pay more in taxes than in the three basic necessities -- account for just one-fifth of the population. By contrast, households earning less than $66,998 -- which include many households that will pay more for the necessities than for taxes -- account for 60 percent of the population.

This doesn’t mean that the Tax Foundation calculation doesn’t have value. "We are very clear that America as a whole -- not the average American -- pays more in taxes than food, clothing, and housing combined," said Tax Foundation economist Kyle Pomerleau. "We are giving Americans a vivid illustration of what the total cost of government is. We hope taxpayers ask: Are the services we receive as a nation worth $4.5 trillion."

Still, Roberton Williams, a fellow at the Tax Policy Center, said the numbers should be taken with a big grain of salt.

"I don't doubt the aggregate numbers cited, but those numbers say little about what happens to particular people," Williams said.

Our ruling

The Tax Foundation post said that "Americans will spend more on taxes in 2014 than they will on food, clothing and housing combined." While a minority of Americans probably does pay more for taxes, the numbers suggest that there are many more Americans whose food, clothing and shelter expenses exceed their tax burden. We rate the claim Half True.

Bureau of Economic Analysis, "Table 2.3.5. Personal Consumption Expenditures by Major Type of Product," accessed April 23, 2014

Bureau of Economic Analysis, "Table 3.2. Federal Government Current Receipts and Expenditures," accessed April 23, 2014

Bureau of Economic Analysis, "Table 3.3. State and Local Government Current Receipts and Expenditures," accessed April 23, 2014

Urban Institute-Brookings Institution Tax Policy Center, "Baseline Distribution of Cash Income and Federal Taxes Under Current Law Share of Federal Taxes by Cash Income Percentile, 2013," accessed April 23, 2014

Urban Institute-Brookings Institution Tax Policy Center, "Baseline Distribution of Cash Income and Federal Taxes Under Current Law by Cash Income Level, 2013," accessed April 23, 2014

PolitiFact, "Reince Priebus says Americans pay more in taxes than on groceries, clothing, shelter combined," April 18, 2011

Email interview with Tara Sinclair, George Washington University economist, April 23, 2014

Email interview with Roberton Williams, fellow at the Urban Institute-Brookings Institution Tax Policy Center, April 23, 2014

Email interview with Kyle Pomerleau, tax foundation economist, April 23, 2014

In a world of wild talk and fake news, help us stand up for the facts.