Get PolitiFact in your inbox.

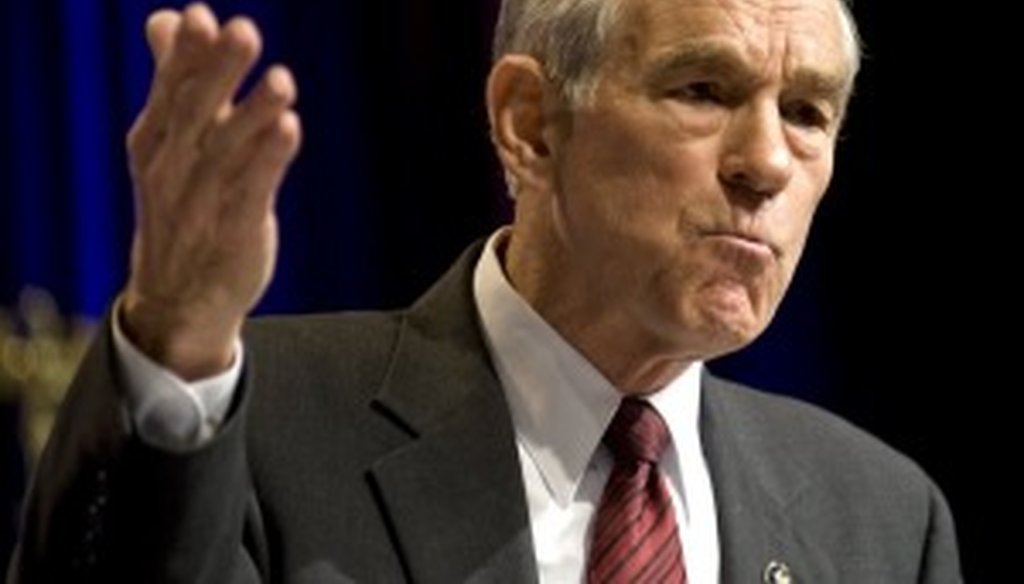

U.S. Rep. Ron Paul, R-Lake Jackson, talked about monetary policy on Comedy Central on Jan. 4.

It's hard to make monetary policy funny, but comedian Stephen Colbert did just that Tuesday night, with a little help from U.S. Rep. Ron Paul, R-Lake Jackson.

Appearing on the Comedy Central show The Colbert Report to tout a return to the gold standard, Paul received this introduction from the show's goofy host: "Soon every citizen will have the right to have their own pot of gold as we convert America to a Leprechauny! Here to advocate for this bright future, please join me in welcoming live via satellite, Congressman Ron Paul."

Paul, a longtime proponent of gold-backed currency, jumped right in.

"The main reason we want gold is over 6,000 years, gold has always been picked over paper," said Paul, who has been appointed chairman of the domestic monetary policy subcommittee of the U.S. House Financial Services Committee. "Paper is always destroyed; there's been no example of paper money lasting for long, long periods of time. Money has always evolved out of the marketplace of something of real value."

For now, we'll set aside whether gold has won out over paper for 6,000 years — possible fodder for a future PolitiFact Texas Truth-O-Meter item. The exchange reminded us that PolitiFact has twice delved into Paul's broader concerns about the nation's monetary policy. We'll deal with those findings below, but first, let's get back to the show.

To counter Paul's position, Colbert turned to David Leonhardt, a business columnist for The New York Times. Leonhardt dismissed as overblown the primary concern of "gold proponents," runaway inflation.

"They've been saying the big worry is that our economy is going to overheat, that we are going to spend so much money, prices are going to go out of control," Leonhardt said. "Does it feel to you like the economy is too strong right now, that it's overheating?" he asked Colbert.

The comedian's deadpan response: "No. But it's waiting for us to let our guard down."

Leonhardt later countered with a question of his own, to reinforce his point about the value of paper money. "If I gave you a choice between the amount of gold in my wedding ring and a million dollars' worth of paper bills, which would you take?"

Colbert punted to Paul, who took the opportunity to bring up another of his favorite topics, the Federal Reserve, and then repeated a claim that has been checked by our sister site PolitiFact Virginia.

"The question is would he take $10,000 and put it in a box and keep it for 20 years, or would he take a couple of gold coins and put them in a box for 20 years," Paul said. "Believe me — 99 percent of the American people, they'll take the gold. They will not bet on the value of the dollar. The Federal Reserve has destroyed 98 percent of the value of the purchasing power of the dollar since 1913."

PolitiFact Virginia fact-checked that Federal Reserve statement in November after the Virginia Tea Party Patriot Federation included it in a letter to the state's congressional delegation calling for an audit of the Federal Reserve System. The letter states: "The Fed, which was created and initially funded with taxpayer gold and monies by an Act of Congress, is opaque and operates in secrecy. It has done so since its inception in 1913. Since that time, the U.S. Dollar has lost 98% of its purchasing power."

After talking to several economists, PolitiFact Virginia rated the statement Half True: "The Tea Party says the buck has dropped by 98 percent, but its use of the gold standard to measure the greenback is not a relevant gauge. Using the Consumer Price index, as many economists recommend, we find the dollar fell by 95 percent since 1913."

We at PolitiFact Texas also tackled this subject after Barbara Cargill, a member of the State Board of Education, said at a March 11 meeting that "the Federal Reserve system has presided over a 95 ... percent decline in the U.S. dollar." She was pushing for a requirement that students "analyze the decline in the U.S. dollar since the inception of the Federal Reserve system in 1913."

We rated her statement Barely True: Cargill was correct that a dollar has about 5 percent of the buying power it did in 1913, but that ignores the relevant fact that Americans also have far more earning power. And the dollar has generally held its value compared to other countries' currencies.

Regarding the thrust of Cargill's statement — that the Fed presided over, or caused, that decline in value — most experts we spoke with traced the decline to inflation rather than specific actions by the Federal Reserve Bank.

As for the gold vs. paper debate, Colbert left Paul, Leonhardt and the viewers at home with this thought: "Would you rather worship a calf made of paper or a calf made of gold?"

We'll leave that one for our intrepid viewers, er, readers.

Our Sources

Comedy Central, The Colbert Report, Jan. 4, 2011

PolitiFact Virginia, "Virginia Tea Party says dollar has lost 98 percent of value under the Fed," Nov. 24, 2010

PolitiFact Texas, "Barbara Cargill says the Federal Reserve presided over a 95 percent decline in the U.S. dollar," March 22, 2010