Although it prides itself on being low-tax, Florida is the only state in the nation to have a business rent tax, a state and local sales tax on commercial lease and license payments. This tax applies both to monthly rent and charges for common area maintenance, customer parking, insurance and other charges landlords pass to tenants. Tenants commonly pay the tax, according to law firm Holland & Knight, which has offices in the United States, including in Jacksonville, Florida, and abroad.

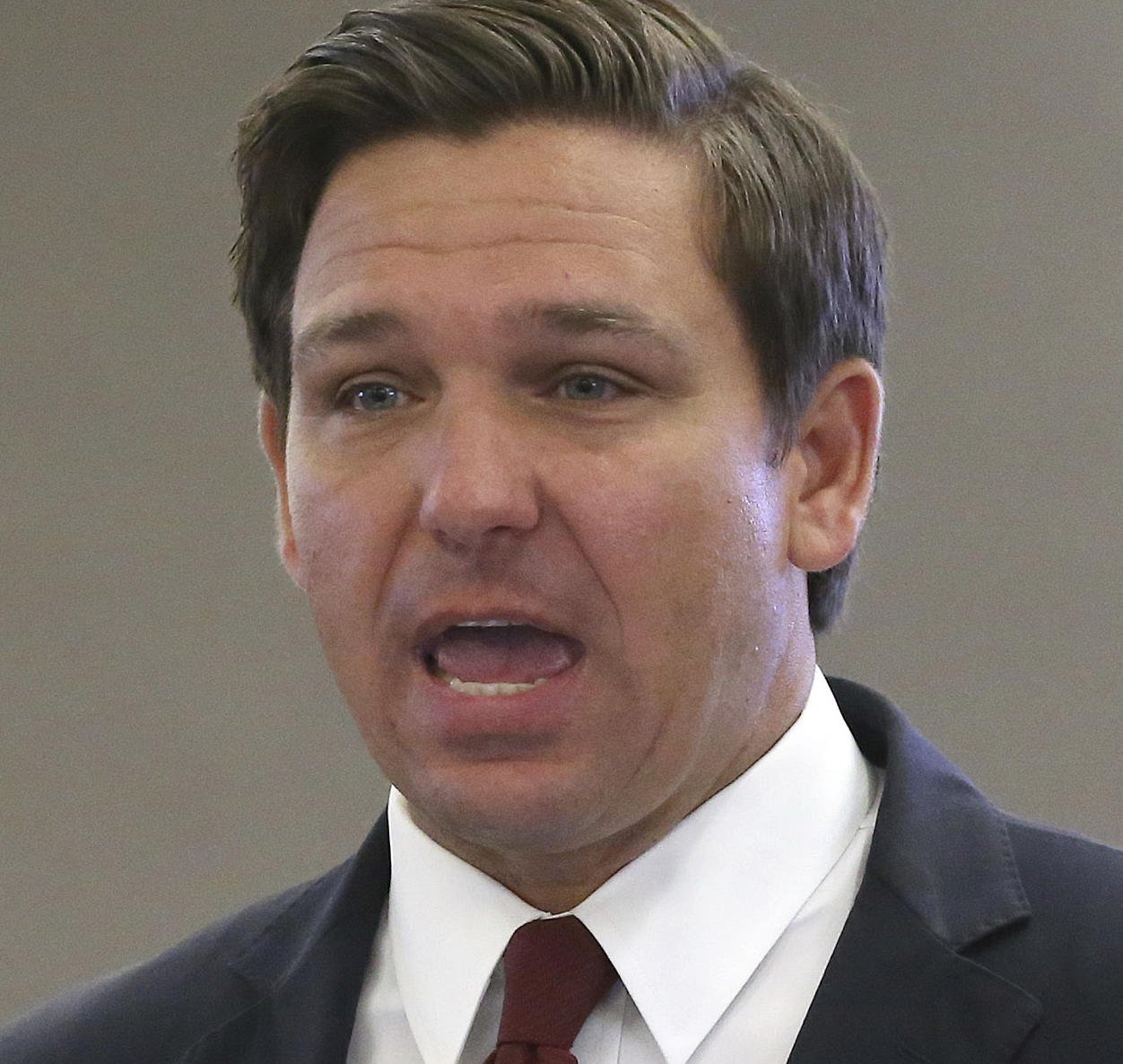

As a campaign promise, Gov. Ron DeSantis railed against the business rent tax, saying it "hits small businesses especially hard" and pledging to phase it out to help businesses "invest money back into growing their company and hiring more employees."

Nearly four years later, how has that promise fared?

In 2021, lawmakers passed SB 50, which lowered the tax from 5.5% to 2%, a change that will take effect once the state's Unemployment Compensation Trust Fund is replenished to a little more than $4 billion, its pre-COVID-19-pandemic amount; experts estimate that will happen within the next two years.

Over the years, organizations including Florida Realtors, a real estate trade group, and Florida TaxWatch, a conservative think tank, have pushed to reduce or eliminate the business rent tax. Florida TaxWatch this year proposed a full repeal of the business rent tax, which would save Florida's businesses and consumers roughly $1.2 billion in 2022-23.

The plan would also have about $2 billion of unappropriated federal recovery funds transferred to the state's unemployment trust fund, which provides eligible recipients with re-employment assistance when they are out of work.

"This proposal presents an opportunity for Florida legislators to take the state's economic resurgence to the next level," Dominic M. Calabro, president and chief executive officer of business-backed policy group Florida TaxWatch, said in a statement. "It places Florida companies in a more competitive position, reduces overhead costs for thousands of small businesses and utilizes more federal relief funds to grow our state's economy."

Since the business rent tax reduction has not gone into effect yet, it's too soon to gauge its economic impact on state businesses or tenants.

When asked by PolitiFact, a Governor's Office spokesperson noted the rate decrease from 5.5% to 2% in 2021's SB 50.

Because the business rent tax will be sliced by more than half but not phased out, as DeSantis promised, we rate this promise Compromise.