Get PolitiFact in your inbox.

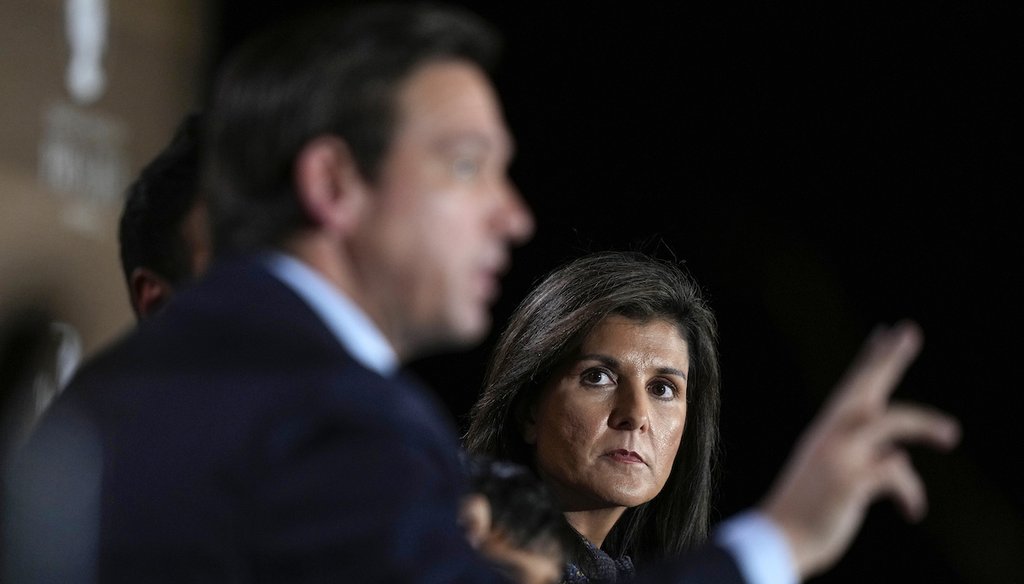

Republican presidential candidate former U.N. Ambassador Nikki Haley listens to Republican presidential candidate Florida Gov. Ron DeSantis, left, speak during the Family Leader's Thanksgiving Family Forum, Nov. 17, 2023, in Des Moines, Iowa. (AP)

Campaign ad from DeSantis PAC says Nikki Haley ‘raised taxes.’ That’s Mostly False.

If Your Time is short

-

As a South Carolina state legislator, Nikki Haley co-sponsored a 2006 bill that raised the sales tax by 1 cent while also cutting property taxes.

-

A university researcher analyzed the legislation and predicted that most homeowners would pay less overall in taxes.

-

As governor in 2015 and 2016, Haley proposed coupling an increase in the gasoline tax with an income tax cut. The proposal didn’t pass during her term.

A political action committee supporting Florida Gov. Ron DeSantis in the Republican presidential primary aired a television ad that tries to link a rival, former South Carolina Gov. Nikki Haley, to former U.S. Secretary of State Hillary Clinton.

The ad that aired in Iowa, by Fight Right Inc., opens with clips of Haley saying, "The reason I got into politics was because of Hillary Clinton." Then, a narrator says, "So, Haley raised taxes like Hillary."

It is not an apples-to-apples comparison because the two politicians oversaw different types of taxes; Haley is a former state legislator and governor and Clinton is a former U.S. senator. But in this fact-check we will focus on the ad’s claim about Haley’s tax record.

The ad cites two tax proposals: one to raise South Carolina’s sales tax and another to raise the state’s gasoline tax.

‘"These were tax swaps, not tax increases," Jared Walczak, vice president of state projects at the Tax Foundation, a group educating the public about tax policy, told PolitiFact.

The ad cites a 2006 bill Haley co-sponsored as a state House member. It was signed into law and raised the state’s sales tax by 1 penny while also cutting homeowners’ property taxes for school operations.

Sarah Young, a University of South Carolina, Aiken political scientist, said that the measure was presented as a "tax swap." Media outlets reporting on the bill used the same term.

"In essence, this meant that most homeowners pay nothing in school operating taxes on their property tax bill" for a primary residence, Young told PolitiFact.

Ellen Saltzman, a Clemson University research associate, analyzed the legislation in 2006 and concluded that most homeowners would pay less overall in taxes under the bill. Writing for the Strom Thurmond Institute of Government & Public Affairs, a research group, Saltzman found that the estimated property tax relief would likely be greater than the additional sales tax homeowners would pay, although the impact would vary based on homeowners’ purchases, home prices and tax rates for local school operations.

Renters paid that sales tax increase but did not benefit from a property tax cut.

Because the property tax relief was limited to owner-occupied properties and excluded commercial real estate, including rental properties, "renters do not receive the benefit of the property tax relief," either directly through lower tax payments or indirectly through lower rent, Walczak said.

"Overall, the tax package was not a tax increase… but the 2006 property tax relief package prioritized homeowners and thus shifted more of the burden to businesses and renters, since they did not receive property tax relief but still faced higher sales tax burdens," he said.

Some lawmakers and school officials objected to this bill from the outset, fearing it would remove a stable school funding base.

Years later, South Carolina journalists found that the tax swap slashed property taxes, but the 1 penny sales tax increase did not make up for the lost revenue for school districts.

Featured Fact-check

The campaign ad also cited a September Fox News article that said that Haley as governor supported a 2016 state gasoline tax increase to pay for infrastructure. The article explained that Haley coupled her proposed gasoline tax increase with an income tax cut, lowering the top income bracket’s rate from 7% to 5% over a decade.

"I’m going to veto anything that is a net tax increase," Haley told reporters in January 2016. "I’m just not going to have it when you’ve got $1.3 billion in new money. I’m not going to do that to the taxpayers of this state."

Ultimately, such a proposal was not approved, NBC in Charleston reported in November 2016.

In 2015, when she proposed the same plan, Haley said that she would sign a gas tax increase only if the state income tax was reduced. "If we do all of those things, we will have better roads and a stronger economic engine for our people. That’s a win-win."

A Haley campaign spokesperson sent us a 2015 article from the Post and Courier, a Charleston, South Carolina, newspaper. It said Grover Norquist, the president of Americans for Tax Reform, which asks politicians to oppose tax hikes, wrote a letter in 2015 to South Carolina state lawmakers urging them to support Haley’s plan.

Haley’s campaign spokesperson also sent articles showing that in 2014, Haley opposed a gasoline tax hike alone, saying there were other ways to increase infrastructure funding.

In 2017, the South Carolina legislature voted to raise the gasoline tax while providing other tax relief, but that was after Haley’s governorship and during her time as former President Donald Trump’s United Nations ambassador.

When contacted for comment, a spokesperson for Fight Right Inc.,the DeSantis PAC, pointed to minor tax measures Haley had supported that the ad did not cite, and were not what most people would consider a broad tax increase. One example was a lodging tax on vacation rentals.

A Fight Right Inc. ad said Haley "raised taxes."

The ad points to 2006 legislation Haley co-sponsored as a state legislator to raise the state sales tax by 1 penny while cutting homeowners’ property taxes. Experts and journalists called the measure a tax swap. And a university researcher’s analysis estimated that with the change, most homeowners would pay less overall in taxes.

People who do not own property saw a sales tax increase, but did not benefit from the property tax cut.

The ad also cites Haley’s 2015 and 2016 proposals while governor to raise the gasoline tax. Again, it was not a stand-alone increase; it was coupled with an income tax cut. And the proposal didn’t pass, so taxes did not change.

The statement contains an element of truth but it ignores critical facts that would give a different impression. We rate it Mostly False.

RELATED: AdWatch: DeSantis super PAC ad misleadingly edits Nikki Haley’s comments about Hillary Clinton

Our Sources

Fight Right, TV ad in Iowa, Dec. 6, 2023

Fox News, Nikki Haley's vow to kill federal gas tax comes years after she supported hiking state gas tax as governor, Sept. 27, 2023

The State, Last hectic day, June 2, 2006

Charlotte Observer, Revaluation might be revived by council, July 14, 2006

Post and Courier, Grover Norquist urges legislators to support Nikki Haley, Jan. 28, 2015

Sarah Young, assistant professor of political science, USC Aiken and Matthew P. Thornburg associate professor of political science, USC Aiken Director, USC Aiken Social Science and Business Research Lab, Findings of the 2021 South Carolina Citizen School Tax Survey, November 2022

Young and Thornburg in the Statehouse Report, OUR TURN: Act 388’s impact on school taxes largely unknown today, study shows, Dec. 16, 2022

Ellen Saltzman at Strom Thurmond Institute, The South Carolina tax swap: the estimated impact of Act 388 on homeowners and renters, 2006

The State, Transcript: SC Gov. Haley’s State of the State speech, Jan. 21, 2015

Greenville News, Tax swap passed in 2006 leaves big hole in S.C. budget, March 1, 2015

NBC - 2 WCBD, New SC Governor could impact top state issues, Nov. 29, 2016

AP, State law passed as property tax relief creating problems, Oct. 18, 2016

New York Times, Fact-Checking Haley and DeSantis in Their Race to Rival Trump, Nov. 15, 2023

Tax Policy Center, What Is Nikki Haley’s Tax and Budget Platform? Nov. 6, 2023

Email interview, Sarah Young, associate professor of political science, USC Aiken, Dec. 10, 2023

Email interview, Taryn Fenske, spokesperson for Fight Right, Dec. 8, 2023

Email interview, Olivia Perez-Cubas, spokesperson for Nikki Haley campaign, Dec. 8, 2023

Email interview, Howard Gleckman, senior fellow at The Urban Institute, Dec. 8, 2023

Email interview, Jared Walczak, vice president of state projects at the Tax Foundation, Dec. 12, 2023

Browse the Truth-O-Meter

More by Amy Sherman

Campaign ad from DeSantis PAC says Nikki Haley ‘raised taxes.’ That’s Mostly False.

Support independent fact-checking.

Become a member!

In a world of wild talk and fake news, help us stand up for the facts.