Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

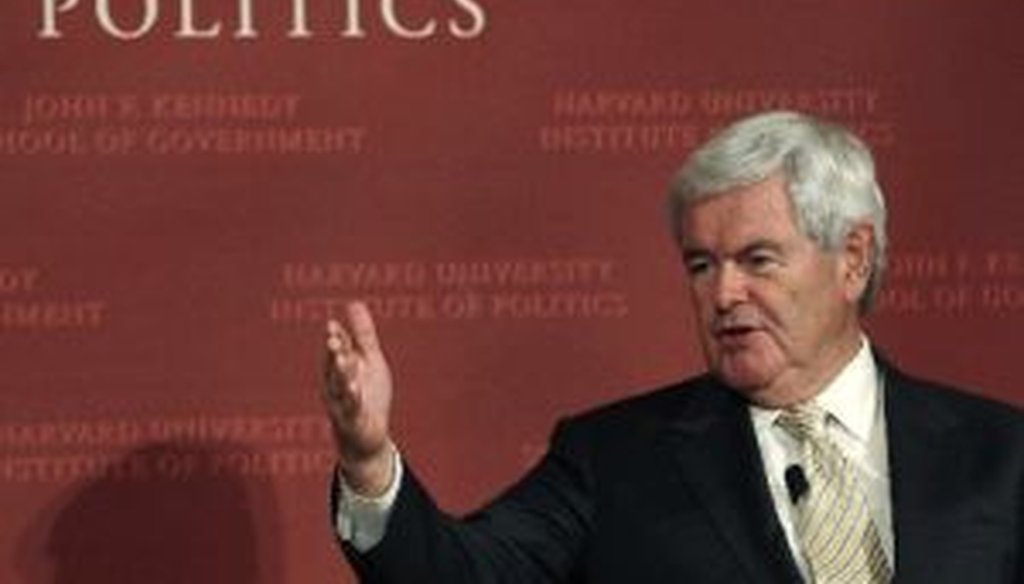

GOP hopeful Newt Gingrich has been critical of President Barack Obama's record on jobs

Community banks are getting a lot of love lately -- and not just from the Occupy Wall Street movement.

GOP hopeful Newt Gingrich offered himself as their defender when he spoke to supporters at campaign headquarters in Manchester, N.H. "Community banks are 12 percent of the banks right now and 40 percent of the loans to small business," Gingrich said. "And they are being destroyed by Dodd-Frank."

What we found was that one year after the passage of Dodd-Frank, community banks are healthier. According to the latest report from the Federal Deposit Insurance Corporation, for that group of banks, a key measure of profitability, return on assets, has doubled in the past year, growing from 0.26 percent a year ago to 0.57 percent in the second quarter of 2011. Return on assets has been higher this year than in any quarter going back to the start of 2008 before the great meltdown.

No doubt the improvement in the economy has helped, but community banks also have benefited from a reduction in fees paid to the FDIC as a result of Dodd-Frank. We ruled Gingrich's statement False.

Our Sources

See Truth-O-Meter item.