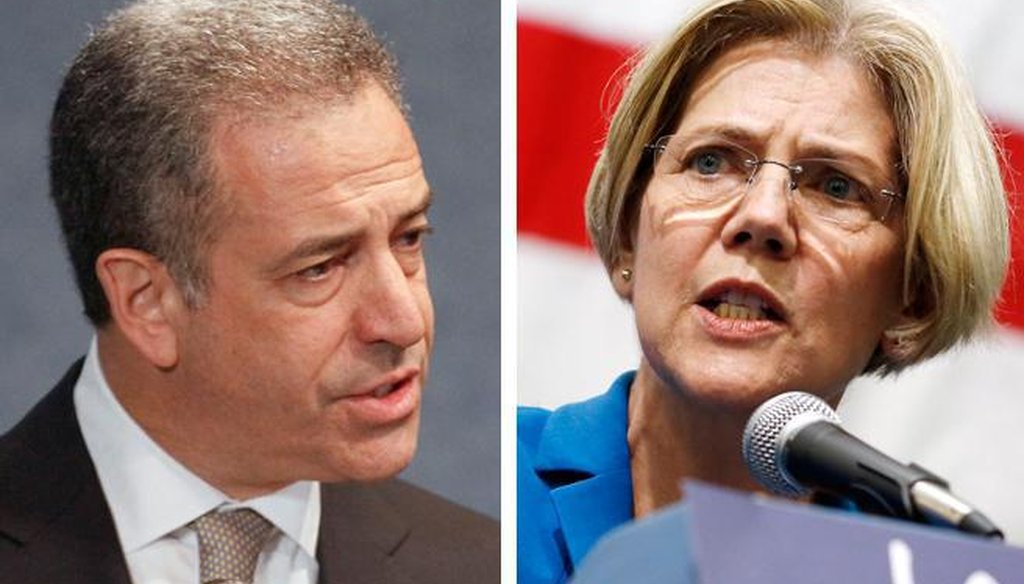

U.S. Sen. Elizabeth Warren campaigned for fellow Democrat Russ Feingold, who is running for his old U.S. Senate seat in Wisconsin, on Sept. 26, 2015 at the University of Wisconsin-Madison. (AP photo)

Campaigning for U.S. Senate candidate Russ Feingold, U.S. Sen. Elizabeth Warren of Massachusetts -- who has been talked up as a potential vice-presidential candidate -- hammered on an issue that she, Hillary Clinton and other national Democrats have seized on:

Student loans.

During her Sept. 26, 2015 speech at the University of Wisconsin-Madison, given with a group of students arrayed behind her, Warren cited an oft-repeated statistic about the $1 trillion in outstanding student loan debt.

Then she suggested that the federal government is an exploitative lender.

"Right now, the United States government charges an interest rate on student loans that covers the administrative costs, covers the bad-debt losses, covers the cost of funds and then -- on top of all that -- makes a profit for the government," Warren said.

"How much profit? Well, let me just give you a little slice of the loans, where we've got particularly good data. The loans that were put out between 2007 and 2012 -- that cohort of loans -- is on target right now to produce $66 billion in profits for the United States government."

Warren went on to say that the government has already spent the "profits."

As we’ll see, there’s an odd anomaly at work here.

In making the $66 billion profit claim, Warren relies on one gold-standard source -- the federal Government Accountability Office.

But another gold-standard source -- the Congressional Budget Office -- says the accounting method used to produce that figure is flawed.

Indeed, when the CBO has employed both the official method (which was mandated by Congress) and its own preferred accounting method, any projection of "profit" for the government from student loans turns into a loss.

That’s because CBO’s preferred method of projecting takes into account more of the risks assumed by the government, such as defaults during hard economic times.

How student loans work

To help students attend college, as a 2012 PolitiFact item reported, the federal government in 1965 took three important steps: Guaranteeing student loans against default; promising a certain interest rate to the banks (even if the rates students paid were lower); and paying additional fees to banks for administration and collection of student loans.

The result: Millions of Americans earned college degrees. But the system required billions of dollars in federal subsidies and produced lucrative revenue streams for banks. Some in Washington, especially Democrats, sought alternatives.

In 2010, a law essentially eliminated the middle man -- the banks. The federal subsidies to the banks were replaced with direct loans administered by the Department of Education and funded through the U.S. Treasury.

The Huffington Post has reported that the government is forecast to generate billions in profits from making student loans. And Republican presidential frontrunner Donald Trump has said the government has turned student lending into a "profit center."

But it’s not so clear cut.

Warren's evidence

To back Warren's claim, her Senate office referred us to a January 2014 report from the Government Accountability Office, an investigative arm of Congress that examines matters relating to the receipt and payment of public funds.

It estimated that the $454 billion in student loans the government disbursed from 2007 to 2012 will generate about $66 billion in "subsidy income" -- or what Warren calls profit.

So, Warren cites a figure from a respected source.

But as we said, the figure uses an accounting method that the Congressional Budget Office has called into question.

Other views

The Washington Post Fact Checker detailed some of this in examining a similar claim, when Warren said the federal government made $51 billion from student loans just in 2013. Her statement earned two Pinocchios -- the Post’s rating for a statement that contains significant omissions or exaggerations.

As The Fact Checker noted, that projection was made using the mandated accounting method, which potentially underestimates the cost of the loans to the American taxpayer. The Congressional Budget Office’s preferred accounting method -- known as fair value -- essentially assesses the risk as private firms would if they made the same types of loans.

We found that the CBO has pointed out the shortcomings of mandated method. In fact, it has argued for using fair value, saying it better takes into account the risks of lending to students.

(Some organizations, such as the left-leaning Center on Budget and Policy Priorities, have argued that fair value makes federal credit programs such as student loans appear more expensive than their actual cost to the government.)

There is quite a difference, depending on which accounting method is used.

In a May 2014 report, the Congressional Budget Office did student loan projections for 2015 through 2024. During that 10-year period, using the official accounting method that Warren relied on in making her claim, the loans are expected to generate a "profit" of $135 billion.

But using the "fair value" accounting method CBO prefers, the projection is an $88 billion loss to the government.

That’s a swing of $223 billion.

Our rating

Warren said student loans issued by the federal government between 2007 and 2012 are on target "to produce $66 billion in profits" for the government.

Warren accurately cites an estimate from a Government Accountability Office report -- but that estimate was made with an accounting method that the Congressional Budget Office says is misleading.

As the CBO has pointed out in another report, using that accounting method, student loans are projected to generate $135 billion in "profit" from 2015 to 2024 -- but using the CBO’s preferred accounting method, they are projected to produce an $88 billion loss.

For a statement that is partially accurate but leaves out important details, our rating is Half True.

More on student loans

Russ Feingold says U.S. Senate opponent Ron Johnson "is opposed to all government-assisted student loans." Mostly True.

Hillary Clinton says Scott Walker rejected legislation to make college loan payments tax deductible and the result was "to raise taxes on students." False.

Wisconsin Eye, video of Elizabeth Warren speech (quote at 46:35), Sept. 26, 2015

Milwaukee Journal Sentinel, "Railing against college debt, Warren fires up Feingold rally," Sept. 26, 2015

PolitiFact Ohio, "Rob Portman says student loan money was used to cover health care reform (Half True)," May 14, 2012

Interview, New America Foundation Federal Education Budget Project director Jason Delisle, Sept. 29, 2015

Congressional Budget Office, "Fair value estimates of the cost of selected federal credit programs for 2015 to 2014," May 2014

Congressional Budget Office, "Should fair-value accounting be used to measure the cost of federal credit programs?" March 5, 2012

Huffington Post, "Student Loan Borrowers' Costs To Jump As Education Department Reaps Huge Profit," April 14, 2014

Government Accountability Office, "Federal Student Loans -- Borrower Interest Rates Cannot Be Set in Advance to Precisely and Consistently Balance Federal Revenues and Costs," January 2014

Politico Magazine, "What happened to Warren the watchdog?" Nov. 10, 2014

Washington Post Fact Checker, "Elizabeth Warren’s claim that the U.S. makes $51 billion profits on student loans (2 Pinocchios)," July 11, 2013

Interview, Urban Institute director of economic policy initiatives Donald Marron, Sept. 29, 2015

In a world of wild talk and fake news, help us stand up for the facts.