Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

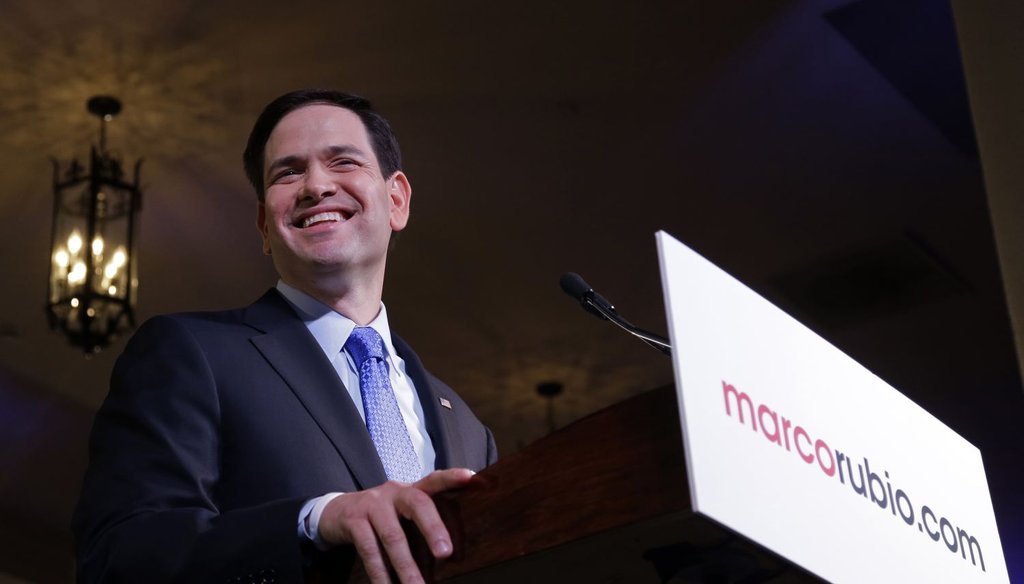

U.S. Sen. Marco Rubio announces his candidacy for the Republican presidential nomination on April 13, 2015. (AP Photo)

Sen. Marco Rubio confirmed his 2016 presidential campaign Monday, but an apparent musical analogy in his announcement speech was a bit off key. During a speech in which he implied his opponents were too old, Rubio accused the competition of wanting to recycle ideas "stuck in the 20th century."

"They’re busy looking backwards, so they do not see how jobs and prosperity today depend on our ability to compete in a global economy," Rubio said. "And so our leaders put us at a disadvantage by taxing and borrowing and regulating like it’s 1999."

Rubio’s campaign didn’t answer our emails, but we’re going to go ahead and assume that last bit is a cheeky reference to Prince’s 1982 smash 1999 -- you know, the one that goes "So tonight I’m gonna party like it’s 1999."

We’ll note the irony of a candidate touting his youth as a campaign strength by citing a 33-year-old pop song. And because it’s a joke to make the point that his opponents are stuck in the past, we won’t put it on our Truth-O-Meter.

That’s good for Rubio, because the U.S. fiscal picture in 1999 -- especially on borrowing --- bears little resemblance to what’s going on today, making for a very poor comparison. (We want to give a shout-out to Steven Dennis at Roll Call, who made the same point about this on Monday night.) Tax burdens were different, the federal budget was running a surplus and a major focus of the 2000 presidential campaign was what Al Gore and George W. Bush would do with all this extra cash America had.

Sign up for PolitiFact texts

Now, it’s difficult to compare the regulatory climates between then and the present day, because there’s no concrete way to measure it. So we’ll give the comparison a pass on that, although we will point out that in 1999 there was bipartisan support to repeal portions of the Glass-Steagall Act, ending the separation between commercial and investment banking. That sweeping end to certain banking regulations in place since 1933 is widely seen as one of the causes of the 2008 housing collapse and subsequent recession.

Taxes and borrowing are much easier to quantify. Roberton Williams, an economist at the Urban-Brookings Tax Policy Center, said a good way to compare 1999 to today is to compare taxes and spending as a percentage of the gross domestic product (the total value of goods and services the country produced). Luckily, the Congressional Budget Office keeps these numbers handy.

For taxation, we looked at how much the federal government took in and its percentage of GDP. While total taxes are greater now, the percentage of those taxes in comparison to our overall economy shows we’re paying relatively less than 15 years ago.

Year

1999

2014

Total tax receipts

$1.8 trillion

$3 trillion

Percentage of GDP

19.2 percent

17.5 percent

For borrowing, we looked at the difference between tax receipts and government spending. The obvious difference is that in 1999, Washington took in more than it spent. The borrowing comes in when the federal government needs to pay those bills.

Year

1999

2014

Surplus/deficit

+$125.7 billion

-$484.6 billion

Percentage of GDP

1.3 percent

-2.8 percent

President Bill Clinton first saw a budget surplus in 1998, and the positive trend continued until 2001 (keep in mind the fiscal year starts in October). The last time the federal budget had run a surplus was in 1969. Even with servicing debt in 1999, borrowing in 2014 far outstripped that year -- or any other year of Clinton’s two terms.

So while Rubio likely isn’t making a literal comparison to 1999, his talking points would be off if he did: Taxes were higher back then, but the budget was balanced, while the opposite is true today.

And what specifics did Rubio give about how he would change America’s fiscal policy? As Prince might say, "Party over, oops, out of time."

Note: This claim was analyzed as part of a reward to our Kickstarter campaign to live fact-check the 2015 State of the Union. Thanks to all who contributed.

Our Sources

YouTube, "Marco Rubio Delivers Campaign Announcement Running for President Full Speech," April 13, 2015

Bloomberg, "Full Text: Marco Rubio Announces Run for President," April 13, 2015

New York Times, "Bush and Gore Revise Plans To Match a Growing Surplus," June 13, 2000

FactCheck.org, "The Budget and Deficit Under Clinton," Feb. 3, 2008

U.S. News & World Report, "Repeal of Glass-Steagall Caused the Financial Crisis," Aug. 27, 2012

New York Times, "How the Tax Burden Has Changed," Nov. 29, 2012

Congressional Budget Office, "The Distribution of Household Income and Federal Taxes, 2011," Nov. 12, 2014

Congressional Budget Office, "The Budget and Economic Outlook: 2014 to 2024," February 2014

Urban-Brookings Tax Policy Center, "Historical Federal Receipt and Outlay Summary," Feb. 2, 2015

Urban-Brookings Tax Policy Center, "Historical Source of Revenue as Share of GDP," Feb. 4, 2015

Mediaite, All the Times Rubio Called Hillary Old in His Campaign Announcement," April 13, 2015

Roll Call, "Marco Rubio’s Opening Speech Had a Goof," April 13, 2015

Tax Foundation, "U.S. Federal Individual Income Tax Rates History, 1862-2013 (Nominal and Inflation-Adjusted Brackets)," accessed April 13, 2015

Congressional Budget Office, Tax tables and data, accessed April 13, 2015

Interview with Roberton Williams, Urban-Brookings Tax Policy Center economist, April 13, 2015