Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

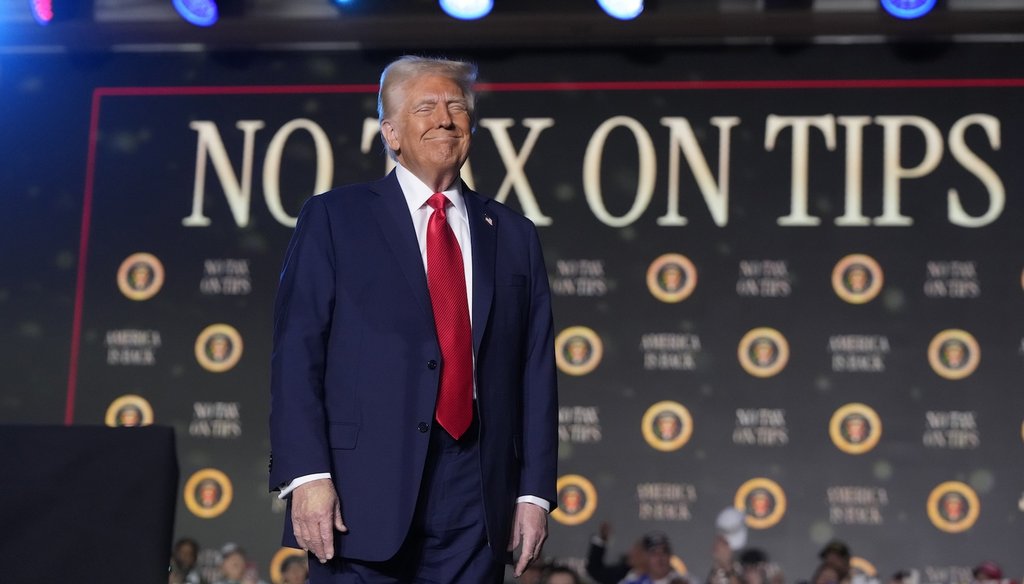

President Donald Trump arrives to speak about the economy during an event at the Circa Resort and Casino in Las Vegas, Jan. 25, 2025. (AP)

President Donald Trump directed his Cabinet to explore the feasibility of creating an External Revenue Service to collect tariff revenues. Congress would need to pass a law to create the agency.

Trump’s action does not eliminate the IRS or federal income taxes.

Trump has proposed extending the 2017 Tax Cuts and Jobs Act and further cutting taxes on certain income, including tips.

In one of President Donald Trump’s first actions after moving back into the Oval Office, he signed a memo to execute his trade agenda, proposing tariff hikes and the creation of an External Revenue Service.

But a recent Facebook post claimed the proposed agency would replace the IRS and eliminate income taxes.

"The IRS will be External Revenue Service, what this means in the near future (paychecks) will not be taxed which means no refund checks for people," the Jan. 22 post said.

The post was flagged as part of Meta’s efforts to combat false news and misinformation on its News Feed. (Read more about our partnership with Meta, which owns Facebook, Instagram and Threads.)

Trump’s memo did not signal the end of the federal income tax, and it did not do away with the IRS. It also did not immediately create an External Revenue Service, but rather directed Cabinet officials to explore the feasibility of creating one.

Trump signed the Jan. 20 executive memo ordering a broad review of U.S. exports and imports and an "America First trade policy." The order emphasizes tariffs, which are taxes paid by companies that import goods from foreign countries.

The memo calls for the Homeland Security, Treasury and Commerce departments to "investigate the feasibility of establishing and recommend the best methods for designing, building, and implementing an External Revenue Service (ERS) to collect tariffs, duties, and other foreign trade-related revenues."

It also calls for a review of the U.S. trade deficit, investigating the country’s trade relationship with China, and a broad review of other trade policies.

The order neither mentions the IRS nor calls for changing how the IRS collects taxes.

Trump had said he would establish the External Revenue Service in his Jan. 20 inaugural address.

"We are establishing the External Revenue Service to collect all tariffs, duties and revenues," he said. "It will be massive amounts of money pouring into our treasury coming from foreign sources."

Currently, Customs and Border Protection collects tariffs on imports. Tariffs are paid by U.S. companies that import goods, not by foreign exporters.

Congress has the authority to create new federal agencies, and it would need to pass legislation to create such an External Revenue Service. Major changes to the federal income tax also require congressional action.

Trump has vowed to renew his 2017 tax plan and enact new tax cuts, including eliminating the income tax on tips. The 2017 Tax Cuts and Jobs Act, which cut income taxes for most Americans and gave the biggest cuts to higher earners, is set to expire in 2025.

During the 2024 campaign, Trump floated eliminating the individual income tax entirely and replacing it with tariffs on foreign goods, though that was not part of his official campaign platform. Economists at the time said the idea was unrealistic because the value of imported goods is far lower than the U.S. tax base.

A Facebook post said Trump signed an executive order that would transform the IRS into the External Revenue Service and paychecks "will not be taxed which means no refunds for people."

Trump’s executive memo did not nix the IRS or income taxes; it directed Cabinet officials to consider the feasibility of establishing an External Revenue Service to collect tariffs. Congressional action would be required to create that agency, which would exist alongside the IRS.

We rate the claim False.

Facebook post, Jan. 22, 2025

The White House, America First Trade Policy, Jan. 20, 2025

JD Supra, Trump 2.0: America First Trade Policy Takes Shape, Jan. 24, 2025

Fox LiveNow, President Trump delivers his inauguration address, Jan. 20, 2025

PolitiFact, PolitiFact’s guide to understanding tariffs and international trade, Nov. 18, 2019

PolitiFact, Who wins and who loses from the tax bill?, Dec. 19, 2017

CBS News, Paying for Trump's tax cuts could lead to big changes for taxpayers. Here's what could be in store. Jan. 24, 2025

Donald Trump campaign website, Platform, accessed Jan. 27, 2025

Cornell Law School Legal Information Institute, Creation of Federal Offices, accessed Jan. 27, 2025

MarketWatch, Trump floats replacing income taxes with tariffs, gets criticized by economists, June 13, 2025

Erica York, X post, June 13, 2025

In a world of wild talk and fake news, help us stand up for the facts.